Revised 2009 Budget tomorrow – Najib’s first test as Finance Minister

Tomorrow when Parliament reconvenes to start the 2009 Budget debate is the first parliamentary test of Datuk Seri Najib Razak as Finance Minister – whether he has a revised 2009 Budget to take corrective measures to shield the country from the world’s worst economic crisis in 80 years so as to enhance competitiveness, boost growth and tamp down inflation.

The first thing Malaysians want to hear from Najib are not platitudes like Malaysia enjoying strong economic fundamentals, financial markets and infrastructure and immunity from external shocks but how the country could be shielded from the worst fallouts of the looming world economic crisis.

Secondly, how Najib proposes to tamp down inflation which had hit a 27-year high largely because of the sharp and unconscionable 41% increase in petrol pump prices in early June.

The price of crude oil has now plunged by almost 50 per cent since striking record high levels above US$147 per barrel on July 11.

The price dropped US$5.61 to US$77.05 a barrel on London’s ICE Futures exchange on Friday.

Energy experts believe prices could go even lower, going down to the US$60 a barrel range.

As Najib has been Finance Minister for 25 days, there is no reason why he is unable to announce a revised 2009 Budget in Parliament tomorrow taking fully into account the sharpest drop of the price of oil in 13 months by lowering the pump prices of petrol. Continue reading “Revised 2009 Budget tomorrow – Najib’s first test as Finance Minister”

Black Friday – Najib should present revised 2009 budget on Monday

Today is Black Friday. The Kuala Lumpur Composite Index plunged 34.88 points or 3.6 per cent to close at 934.01, falling to its lowest level since July 2006.

We are feeling the effects of the world financial meltdown as the United States Government’s US$700 billion (RM2.5 trillion) bailout has failed to inspire confidence that it is sufficient to avert a looming world economic depression.

But this is not the only bad news for Malaysia, which has been aplenty lately particularly our deteriorating national competitiveness.

Yesterday, for instance, it was announced that for the second consecutive year, not a single Malaysian university has succeeded to get listed in the 2008 THES-QS World Top 200 Universities while a fortnight ago, Malaysia’s ranking on the Transparency International Corruption Perception Index 2008 plunged 10 places to No. 47 in 2008 from No. 37 five years ago in 2003 when Datuk Seri Abdullah Ahmad Badawi became Prime Minister.

What disturb Malaysians is that the Barisan Nasional government is totally at sea and unprepared to face the looming world financial crisis, as the Ministers and BN leaders are too preoccupied fighting for survival in their respective political parties to be able to plan out a strategy to save the Malaysian economy from the world financial meltdown. Continue reading “Black Friday – Najib should present revised 2009 budget on Monday”

PM should seek Parliament approval on June 23 for hefty oil price increases

Ipoh’s protest :

KL’s protest :

Some hundred people, including DAP MP for Ipoh Barat, M. Kulasegaran, Perak State Assembly Speaker Sivakumar, Perak DAP State Excos Su Keong Siong, A. Sivanesan and Chen Fook Chye and DAP Perak Assembly members Leong Mee Meng (Jalong), Lim Pek Har (Menglembu), Ong Boon Piow (Tebing Tinggi) and Siva Subramanian (Buntong), together with representatives from trade unions and NGOs, gathered outside the Perak Federal Building this morning to fire the first salvo of protest on behalf of Malaysians at the hefty and unconscionable increase of oil prices yesterday.

The half-hour protest went off smoothly, with Kula, Su, Sivanesan, Chen and myself speaking briefly on the protest.

In Kuala Lumpur, a similar protest, attended by five DAP Federal Territory MPs (Dr. Tan Seng Giaw, Fong Kui Lun, Tan Kok Wai, Teresa Kok, Lim Lip Eng), Manogaran (MP – Teluk Intan) and Selangor DAP State Assemblywoman Jenice Lee Ying Ha (Teratai), was held at the Pudu Market, Jalan Pasar.

Excerpts of my remarks at the Ipoh Protest this morning:

The sudden hefty oil price increases – 40.6 per cent and 63.3 per cent increase in pump petrol price and diesel price respectively – creating a seven-hour nation-wide chaos is an outrage as it is most unconscionable, unjustifiable and deplorable reflecting poorly on good governance in Malaysia especially after ministerial undertaking that there would be no changes until August.

The introduction of annual cash rebate of RM625 to those who own cars of 2,000 cc and below, and pick-up trucks and jeeps of 2,500 cc and below, and cash rebate of RM150 a year for owners of motor-cycles of 250 cc and below, as well as road tax discounts, will not be able to fully cushion the low and middle-income Malaysians from the inflationary spiral which would be unleashed by the greatest hike in oil prices in the nation’s history.

Equally of concern will be the deterioration of the public safety index, with the expected worsening of the crime situation which has already become an endemic problem causing Malaysians, tourists and investors to fear for their personal safety, their loved ones and the safety of property as well! Continue reading “PM should seek Parliament approval on June 23 for hefty oil price increases”

Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (3)

By Dr Teck-Yong Eng

5. What measures have the government put in place to explore and exploit Malaysia’s strategic and cultural position of two major growing economies in Asia, India and China?

Malaysia’s foreign economic policy with regards to India and China remains relatively under tapped from a strategic viewpoint. Despite our geographical proximity, advantage of language and cultural similarity, and established networks with commonwealth countries (serve as potential economic and business conduits), there is no evidence of systematic economic initiatives in helping Malaysian businesses to see the bigger picture of economic rewards and how Malaysia could leverage its economic position. Continue reading “Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (3)”

Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (2)

By Dr Teck-Yong Eng

2. Have ordinary citizens benefited from the period of economic boom or growth from the mid to late 1990s? If not, what went wrong and what lessons can be drawn to prevent such recurrence?

Unfortunately, only a minority of people reaped the rewards of the long gone boom period in the Asia region. Again, most would argue that this is due to deeply entrenched corruption, nepotism and cronyism in awarding projects, siphoning state resources, and misusing funds and abusing of power. I would refrain from the topic of corruption and clean governance to focus on economic and wealth distribution. Continue reading “Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (2)”

Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (1)

By Dr Teck-Yong Eng

The People have delivered their verdict on the recent Malaysia’s 12th general election and it is time for all bickering about political rhetoric to take a back seat. In the midst of chaotic restructuring and constant backstabbing of politicians, the opposition could lose focus on turning the election manifestos into reality and serving the people.

Economic wellbeing and progress of the nation is one of the main reasons for the people’s dissatisfaction with the ruling government (BN), which transpired to a historic election defeat.

In a crude sense, our economic malaise especially economic and wealth distribution is not the sole responsibility of the current PM but has been simmering under the various positive headlines with politically motivated agenda of the previous premier. Continue reading “Reflections on Malaysia’s Economic Progress and Wealth Distribution: Some Key Questions to Policy Makers (1)”

Barisan Nasional 2008 Manifesto of Lies and Falsehoods?

(Media Conference Statement at DAP Ipoh Timur Ops Centre on Thursday 28th February 2008 at 1 pm)

I greatly regret that the caretaker Prime Minister Datuk Seri Abdullah Ahmad Badawi has resorted to intemperate language in accusing the DAP of spreading lies in the 2008 general election campaign, as illustrated by today’s Sun front-page headline: “BN leaders on offensive – PM: Opposition Spreading lies to Undermine Barisan Unity” and Utusan Malaysia’s front-page headline “Pembangkang iri hati – Tabur tohmahan, fitnah kerana kejayaan BN tadbir Negara – PM”.

I do not want to respond in kind to reciprocate Abdullah’s intemperate language, or I will describe the 2008 Barisan Nasional (BN) Election Manifesto as a Manifesto of Lies and Falsehoods – with a very great difference, I will be able to prove my charge that the 2008 Barisan Nasional Election Manifesto is a Manifesto of Lies and Falsehoods while Abdullah will not be able to substantiate his ridiculous charge that the DAP is guilty of spreading lies to undermine BN unity. Continue reading “Barisan Nasional 2008 Manifesto of Lies and Falsehoods?”

Financial strenth, economic resilience

Maintaining Islamic Finance Leadership

As highlighted in the previous years’ budget, Malaysia has progressed significantly in the development of Islamic financial services, especially in terms of the size of investments and an increase in the number of institutions. Malaysia was the first to issue a global sukuk in 2002, as well as the first country where supranationals have issued ringgit-denominated Islamic bonds, namely the International Finance Corporation with an issuance of RM500 million and the World Bank, RM2 billion. In 2006, Malaysia was the largest issuer of Islamic bonds in the global capital market, accounting for USD30 billion, which is more than 70% of the overall global issuance of USD41 billion.

With the continued growth of importance in Islamic finance, we want to encourage more of this business to come to Malaysia. There is approximately US$500 billion of funds within the Islamic finance system, growing at around 15% annually. In the Gulf and Asia, Standard & Poor’s estimates that 20 per cent of banking customers would now spontaneously choose an Islamic financial product over a conventional one with a similar risk-return profile.

However the market’s growth in importance has also attracted some of the largest capital markets in the world such as the United Kingdom and Singapore to develop financial services and products to capture this market, which will result in a loss of market share for Malaysia. For example, one of the largest sukuk to date issued by Dubai Ports was written out of the London office of Barclays Capital in January 2006. And in August 2006, the first billion dollar sukuk to be listed on the London Stock Exchange raised £2.5 billion (US$5 billion). In addition, ambitious plans have been announced to make London the western capital of Islamic finance as the government announced tax relief for sukuk in March this year.

Nearer home, Singapore is increasingly serving as a bridge between the Middle East and Asia. More Middle Eastern banks are setting up in Singapore, which is experiencing double-digit growth in funds originating from the Middle East, for investment in Asian capital markets and real estate. Given Singapore’s lead in the Over-The-Counter (OTC) derivative market as the fourth-largest foreign exchange trading centre in the world, they will certain provide stiff competition for Malaysia. Continue reading “Financial strenth, economic resilience”

Reliance on Oil & Gas

Malaysia is a country blessed with abundant natural resources. In particular, we are thankful that the country is rich in oil and gas, which created Malaysia’s sole representative in the Fortune 500, Petroliam Nasional Berhad (Petronas).

In the most recent financial year ending March 2007, Petronas achieved record profits before tax of RM76.3 billion thanks to record high crude oil prices which increased from under US$25 per barrel to above US$70 all within four years.

Of greatest importance, was the fact that Petronas contributed RM53.7 billion to our national coffers in taxes, royalties, dividends and export duties last year.

Contribution from Petronas and other oil and gas companies operating in Malaysia was budgeted to make up some 46.8% of the government revenue for 2007.

This represents a steep increase from approximately 30% in 2006 and 25% in 2004. These statistics marks Malaysia’s heavy reliance on oil and gas industry today.

Malaysia’s abundance of oil & gas resources is akin to striking lottery. It is a once-off affair, and at some point of time, our reserves will run dry.

According to Oil & Gas Journal, Malaysia held proven oil reserves of 3.0 billion barrels as of January 2007, down from a peak of 4.6 billion barrels in 1996. These reserves will last us for only another 20 years or so.

In addition, Malaysia is expected to become a net oil importer by 2010 assuming a conservative growth of 4% in petroleum products consumption. Our trade current account surplus has also been boosted significantly by oil and gas related products which constitutes more than 11% of our exports.

The frightful acceleration of dependence on our limited oil and gas resources places the country’s economy at great risks. Continue reading “Reliance on Oil & Gas”

Challenges of globalisation

Globalisation brings both new threats and opportunities for the Malaysian economy. Should we rest on our laurels and continue to believe that we can be sheltered by the proverbial coconut shell, it will only result in irreparable damage to the economy. However, if we were to instil in our economy the spirit of resilience as well as the ethics of competition, hard work and innovation, Malaysia will be able to achieve its full potential via the vast opportunities provided by globalisation.

Today, capital, enterprise and talent are flowing to countries where government can be trusted, where the workforce is well-educated and skilled, and where the quality of life is high. These are key pillars of our economy and our country which we must build in order to reap the full benefits of globalisation.

Malaysia used to attract some of the biggest technological giants such as Intel, Motorola and Dell to develop and manufacture their latest technologies in the country. However, in the past decade, we have clearly fallen behind in terms of advancement in manufacturing technology. For example, Malaysia’s current leading semi-conductor wafer-fabricator, SilTerra Malaysia Sdn Bhd offers major foundry compatible CMOS logic, high-voltage and mixed-signal/RF technologies down to 130 nanometer feature size. SilTerra’s wafer fab has a design capacity of 40,000 eight-inch wafers per month.

However, semi-conductor technology has advanced significantly with state-of-the-art 90-nm technology on 300-mm wafers, and 65-nm production. In fact, 45-nm process technology is now under aggressive development. Our neighbours, Singapore, for example, is attracting more of the ‘first-of-its-kind’ investments such as the chip used in the latest PlayStation3 and Xbox. A French semiconductor company, Soitec, is investing $700 million to set up in Singapore its first offshore facility to make the wafer for this chip. It is high precision, high technology. The wafers have alternating layers of silicon and insulator, unlike conventional wafers which use silicon throughout. Singapore became the only country in Asia that it trusts well enough to set up its first manufacturing campus outside of France. Hence, it is key for Malaysia, in the age of globalisation, to bring back global investments in leading age technologies. Continue reading “Challenges of globalisation”

Economic Prospects — Dangerous Times ahead

The budget offers the rosy view that the Malaysian economy will continue to be resilient, with a projected growth of between six and 6.5 percent in 2008.

The economic prospects need to be placed in perspective. First and foremost, the external economic environment has sharply deteriorated and the international agencies and governments of the developed countries have turned bearish on global economic growth prospects in the wake of the US sub-prime crisis. Some analysts have even gone so far as predicting a recession.

Malaysia, as an open economy, is not immune from these adverse developments. History indicates that a global slowdown impacts on Malaysia in a magnified manner — lower exports linked to weak demand and lower commodity prices; lowered inflows of capital and through multiplier effects contributing to lower domestic economic activity, lower domestic investment, and lower government revenues which in turn force the government to increase borrowing with the inevitable growth in the deficit.

Thus, the over-optimistic assumptions and forecasts lack credibility. The prognosis for 2008 must thus be viewed at best as one of increased uncertainty and heightened risk.

A more realistic assessment would be that Malaysia may face an economic crisis and will need to change course to withstand the looming economic storm. It cannot continue on the present path. It is deeply troubling that the Government does not appear to have recognized the perilous circumstances that are now unfolding. Continue reading “Economic Prospects — Dangerous Times ahead”

Malaysia must adopt global policies and strategies to survive

by Dr. Chen Man Hin

The Barisan Nasional government frequently makes pronouncements that the economy is sound, with GDP growth rates of 5% and above.

However the following statistics of per capita income do not give a flattering picture of Malaysia:

PER CAPITA INCOME OF SELECTED ASIAN COUNTRIES

1967/ 2005

Malaysia US290/ 5,042

Singapore 600/ 26,836

Hong Kong 620/ 25,493

Taiwan 250/ 15,203

S. Korea 160/ 16,308

In 1957, Malaysia had the second biggest per capita income after Japan, but now we are at the tail end among the front-rank developed nations in Asia. Continue reading “Malaysia must adopt global policies and strategies to survive”

Cross listing of Malaysian Corporations in foreign stock exchanges

CROSS LISTING OF MALAYSIAN CORPORATIONS IN FOREIGN STOCK EXCHANGES

by Dr. Chen Man Hin

Perlis Palm Oil Berhad, a subsidiary of Perlis Plantation Berhad is in the process of being merged with Wilmar Corporation a Singapore listed corporation. The move seems to have created anxiety in the business community.

There are fears that a large corporation being absorbed by a foreign company may bode ill for the country as capital is being taken out, and is of bad omen.

Concern has also been expressed that corporate mogul, Tan Sri Robert Kuok is pulling his business conglomerate out of Malaysia. This may mean the beginning of an exodus of capital from the country. There is no basis for such speculation.

The fact is that cross listing of corporations is a common international practice adopted by world class companies, which for strategic reasons often choose to list their companies in the stock exchanges of different countries.

Examples are Hong Kong Shanghai Bank which is listed in Hong Kong, London and New York. So also with China Life a giant insurer in China, is listed on Hong Kong, New York and Shanghai, also Infosys a well known Indian IT corporation is listed both in India and New York. Continue reading “Cross listing of Malaysian Corporations in foreign stock exchanges”

Tun Ismail: No Ordinary Politician

Review by Bakri Musa

Tun Ismail: No Ordinary Politician

The Reluctant Politician: Tun Dr. Ismail and His Time

Ooi Kee Beng

Institute of Southeast Asian Studies, Singapore, 2006

338 pp RM55.00

Reading Ooi Kee Beng’s biography of the late Tun Ismail is akin to eating at a buffet in a cheap Chinese restaurant. The offering was generous and you gorged yourself. However, an hour later you were hungry again; worse you could not even recall what was so special about the menu. Then it dawned on you that the food tasted good simply because you were so darn hungry.

With the present pathetic state of leadership in Malaysia, there is a yearning for the kind of leaders like the late Tun Ismail, men of

strong convictions and who did not hesitate acting on them. Ooi quoted Prime Minister Tunku Abdul Rahman who bore the wrath of Ismail’s anger over Tunku’s sudden policy change towards China. Ismail was so incensed that he tendered his resignation immediately. You would never see that kind of bravery among today’s leaders; they are more adept at toadying and ingratiating themselves.

Ooi worked hard for his book, interviewing scores of people and reviewing many documents locally and abroad. There is no shortage of quotes and anecdotes from those who knew Ismail, and Ooi added many details of Tun’s life. Therein lies the problem. The essence of the man gets buried in the avalanche of factoid overload. It does not enlighten us to know that he was awarded the National Order of Vietnam, or that he was president of the American Malaysian Society.

Ooi did not have to quote every interview. The book could do without the many “He was tough, brilliant, blunt, … ” type of general comments. They added nothing and took up valuable space.

Two interviewees, Lee Kuan Yew and Ghaffar Baba, stood out; they illuminated well Ismail’s character. Lee was expounding in his usual erudite and logical manner on a particular issue. At the end he asked Ismail what he thought about it, and the Tun simply replied, “I disagree!” Flabbergasted, Lee asked Ismail for his reasons, at which point Ismail remarked that since Lee had so brilliantly enumerated all the salient points there was nothing more for him (Ismail) to add. That reflected supreme self-confidence. By not trying to “out lawyer” the lawyerly Lee, Ismail stumped him. Continue reading “Tun Ismail: No Ordinary Politician”

Winning back FDIs – fundamental policy changes needed and not merely incentives

Winning back FDIs

by Dr. Chen Man Hin

Prime Minister Datuk Seri Abdullah Ahmad Badawi announced a bouquet of incentives to induce foreign investors to put their money in Johore’s Iskandar Development Region (IDR). Undeniably the incentives are attractive.

While the development of IDR is important and should be encouraged, it is vital to realise that foreign investments are needed badly for the country as a whole. Therefore, the incentives for IDR should logically be implemented for the whole country.

Malaysia unfortunately is bypassed by foreign investors and is low in their choice to park their money. It is definitely not on the radar of foreign investors, contrary to the claim of the Minister for International Trade, Datuk Paduka Rafidah Aziz.

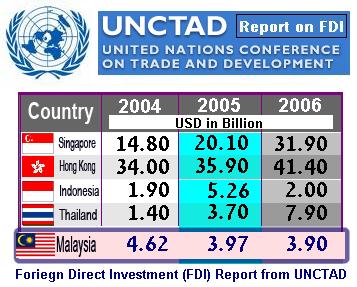

UNCTAD report on FDI shows that Malaysia has much lower FDIs than many other countries in ASEAN – Continue reading “Winning back FDIs – fundamental policy changes needed and not merely incentives”

Malaysia-US FTA – Questions for Rafidah

On Tuesday, Minister for International Trade and Industry, Datuk Paduka Rafidah Aziz, gave a 21-page reply to questions on the Malaysia-US FTA talks and developments.

Rafidah said that the sovereign right of the government to make and implement certain national policies for the interests of the rakyat and country is one of the fundamental issues that are non-negotiable for Malaysia in any bilateral FTA.

Malaysian sovereignty

I want to raise 3 matters of vital public importance that are on the negotiation list.

First is the issue of the mandatory labelling of genetically modified organisms (GMOs) and products containing GMOs. The Biosafety Bill that has passed the first reading in this House is necessary to safeguard public health and the environment. An important provision is the one that requires mandatory labelling, and we understand that Draft regulations for labelling of genetically modified food are ready and notified to the WTO. For consumers who may have allergenic reactions to certain GM products or have religious reasons to reject such products labelling is essential.

I raise this because the US Trade Promotion Authority (TPA) Act expressly states that labelling of biotechnology products is a practice that should be eliminated as it decreases US export opportunities when consumers choose not to consume GM food.

The US Biotechnology Industry Organization (BIO) and the AMCHAM Malaysia/US Chamber of Commerce have opposed mandatory labelling of genetically modified products or foods in their public submissions to the US Trade Representative. In particular, AMCHAM Malaysia/US Chamber of Commerce state that such labelling “should be firmly opposed by the U.S. in the FTA Negotiations”.

Many countries (such as Japan, China and many European countries, and even Australia which signed an FTA with the US) already require mandatory labelling. This is consistent with the WTO Agreement on Technical Barriers to Trade which states that “technical regulations shall not be more trade-restrictive than necessary to fulfil a legitimate objective”.

The legitimate objectives include “national security requirements,

prevention of deceptive practices, protection of human health or safety, animal or plant life or health, or the environment” (emphasis added). The prevention of deceptive practices includes product information and labelling, so it is clearly within our sovereign right to have mandatory labelling of GMOs and GM products.

Under the Codex Alimentarius Commission, the joint WHO/FAO body regulating international food standards, the Committee on Food Labelling has been discussing a global standard for mandatory GM food labelling. The draft standard on GM labelling has support from a majority of the Committee, including Malaysia.

Is this one of the areas of national sovereignty that will be non-negotiable?

Continue reading “Malaysia-US FTA – Questions for Rafidah”

RM149 billion KLSE losses in 5 days – PM/Ministers not stock market consultants

The Cabinet tomorrow should warn off all Ministers to stop acting as investment consultants to talk up the market after the expensive lesson of RM149 billion losses suffered mostly by small investors in the stock market in the past week after the Prime Minister, Datuk Seri Abdullah Ahmad Badawi’s Chinese New Year advice to enter the market to “ride on the momentum”.

Small investors had overcome their skepticism and reluctance to enter the stock market following the Prime Minister’s exhortation at the Gerakan Chinese New Year open house in Kuala Lumpur on the first day of the Chinese New Year on February 18, 2006 to enter the stock market to “ride on the momentum” of the good economic times on the ground that the Kuala Lumpur Composite Index (KLCI) could surpass the 1,350-point level following positive indicators of the country’s economic growth — namely the trillion ringgit total trade last year, the increasing foreign and domestic investments and the rising ringgit.

In less than a week, small investors who acted on the advice of the Prime Minister and flocked into the stock exchange were badly burnt.

In two days on 27th and 28th February, the KLSE plunged 76.42 points from 1,272.87 to 1,196.45, wiping out RM69.45 billion market capitalization in two days.

It is deplorable that Abdullah, who was visiting Yemen at the time, did not immediately learn the lesson that as Prime Minister and Finance Minister, he should not double up as stock market adviser as he persisted in advising Malaysians “to have confidence and be prepared to invest in the KLSE to attract bigger foreign participation”.

Other Cabinet Ministers have also got into the act to double up as investment consultants. Continue reading “RM149 billion KLSE losses in 5 days – PM/Ministers not stock market consultants”

PM’s CNY present – RM70 billion Bursa Saham losses by small investors

The Prime Minister Datuk Seri Abdullah Ahmad Badawi had a special Chinese New Year message for Malaysians in the first two days on the Chinese New Year on February 18 and 19, 2006 — to enter the stock market to “ride on the momentum” of the good economic times.

This was his common theme at the Gerakan Chinese New Year open house in Kuala Lumpur on the first day of the Chinese New Year and at the open house of the Penang Chinese Chamber in Penang on the second day of the Chinese New Year.

Abdullah pointedly said that the Bursa Saham composite index, which was at the time at a high of more than 1,258 points, could surpass the 1,350-point level following positive indicators of the country’s economic growth — namely the trillion ringgit total trade last year, the increasing foreign and domestic investments and and the rising ringgit. (New Straits Times 21.2.07)

There had been widespread skepticism about the slew of “good economic news” which had been trotted out by the government in the previous two weeks, particularly about foreign direct investments which clearly conflicted with statistics released by the United Nations Conference Trade and Development (Unctad) — raising the question as to why there is a difference of between RM6.4 billion to RM9.8 billion in the statistics released by the Ministry of International Trade and Industry (MITI) and Unctad on 2006 FDIs into Malaysia.

However, when the Prime Minister openly urged Malaysians to enter the stock market “to ride on the momentum” in expectation of the KLSE rising above 1,350 points, small investors cast aside their doubts, reservations and skepticism and entered the stock market in a big way after the Chinese New Year holidays, lifting the KLCI to close at 1,283 points last Friday — with the Star yesterday carrying the screaming headline “KLCI poised to break record” for this week. Continue reading “PM’s CNY present – RM70 billion Bursa Saham losses by small investors”

Why the difference of RM6.4 billion or RM9.85 billion in MITI and UNCTAD figures for 2006 FDIs

For the past two weeks, Malaysians had been fed with the news that good economic times are back, with the country drawing a record RM20.2 billion in foreign investment in manufacturing, a record 2006 trade volume breaching RM1 trillion, rocketing share prices, a strong ringgit and rising foreign reserves.

The Prime Minister Datuk Seri Abdullah Ahmad Badawi had denied that an imminent general election is on the cards because of the slew of good economic news to generate a “feed good euphoria” reminiscent of the period before the 2004 general election.

Although the next general election will not be held in the next few months, everyone would expect the holding of early general elections in the next eight to 14 months before April 2008, when Datuk Seri Anwar Ibrahim would regain his civil liberties including the right to stand for elections at the end of his five-year disqualification from the date of his prison release.

But are the good economic times back for the people of Malaysia? If so, a little-noticed announcement on Chinese New Year’s Day has sent out a very different message.

On February 18, 2007, Bernama reported that the government had scrapped its earlier plan to extend the textbook loan scheme to all school students, both at primary and secondary level, from next year. Deputy Education Minister, Datuk Noh Omar was quoted as saying that the move was scrapped as the ministry would incur an extra sum of over RM100 million yearly.

When the government has to cancel the textbook loan scheme for all students because it cannot afford the additional expenditure of RM100 million, it strains credibility to believe that the government and the country is aflush with funds.

Malaysians have been told in the past fortnight that the country is back on the global investment map, in reversal of the gloomy news in the past few months that Malaysia is in danger of dropping out from the radar of foreign investors because of increasing lack of international competitiveness, whether in efficiency of public service, quality of education, good governance, transparency and integrity. Continue reading “Why the difference of RM6.4 billion or RM9.85 billion in MITI and UNCTAD figures for 2006 FDIs”