Winning back FDIs

by Dr. Chen Man Hin

Prime Minister Datuk Seri Abdullah Ahmad Badawi announced a bouquet of incentives to induce foreign investors to put their money in Johore’s Iskandar Development Region (IDR). Undeniably the incentives are attractive.

While the development of IDR is important and should be encouraged, it is vital to realise that foreign investments are needed badly for the country as a whole. Therefore, the incentives for IDR should logically be implemented for the whole country.

Malaysia unfortunately is bypassed by foreign investors and is low in their choice to park their money. It is definitely not on the radar of foreign investors, contrary to the claim of the Minister for International Trade, Datuk Paduka Rafidah Aziz.

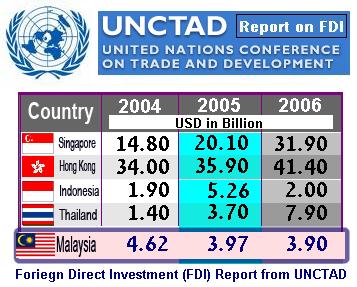

UNCTAD report on FDI shows that Malaysia has much lower FDIs than many other countries in ASEAN –

2004 2005 2006

(billions of dollars)

Malaysia US 4.62 bill US3.97b US3.9b

Indonesia 1.9 5.26 2.0

Thailand 1.4 3.7 7.9

Singapore 14.8 20.1 31.9

HongKong 34.0 35.9 41.4

UNCTAD figures do not lie. Clearly Malaysia is in dire straits. The figures show that Thailand is now preferred by foreign investors with Indonesia fast catching up, not to mention Singapore which is far ahead.

The incentives for IDR of South Johore should be offerred as incentives for the whole of Malaysia.

Foreign investors also look at political measures taken to promote democracy, unity and stability. Indonesia has implemented policies which give foreign investors confidence.

Indonesia has revoked its pribumi policy by passing a law that gives equal citizenship to all Indonesias irrespective of race or religion. The Indonesian Parliament has declared Indonesia to be a secular state and not an Islamic state, although it has the largest number of muslims in the whole world. There is also economic freedom without racial bias.

Foreign investors tend to look favourably to countries that are non-racial, secular and a liberal economy.

The same cannot be said for Malaysia with its Malay agenda of ketuanan melayu, New Economic Policy to favour bumiputras and leanings towards an Islamic state.

Unfortunately, Malaysia is the only Asean member which embraces a racial policy of ketuanan Melayu, a bumiputra-biased economy and a pro-Islamic state philosophy.

It is no wonder that foreign investors do not include Malaysia on its radar.

The simple and logical reason that foreigners are not comfortable with any policy of discrimination is because if the Government can discriminate against its own citizens, what are the chances for them not receiving the same treatment. Indonesia has seen this and that is why they had revoked their discriminatorily policy. When is Malaysia going to see this?

Oh yes, we will change the policy when the oil wells run dry!

Malay agenda of ketuanan melayu, New Economic Policy : double whammy loss for Malaysia in terms of not only foreign investments avoid here and divert elsewhere but our local entrepreneurs too go take their investments and put their money elsewhere.

Dr Chen, I agree with you completely.

Incentives isn’t the be-all and end-all to investors. All countries offer incentives of their own. It’s a competitive bidding war for FDI out there….just like any other business. Investors who shop around will look at a host of other factors: ‘L’ to the power of 8.

Legal System – assurance of reliable system of justice & integrity;

Labour Force – skills & training, language competence, availability;

Land Costs – rental, purchase values, security of tenure;

Local Markets – critical mass locally;

Logistics – transportation system: roads, railways, airlinks;

Linkages in trade – FTAs, AFTA etc;

Local Politics – race, religion, affirmative policies (NEP) etc;

Local Monetary System – forex controls, stability of currency etc;

AAB should open his eyes to realise that just incentives cannot ‘kowtim’ everything in a complex world today; or like the Cantones say ‘one leg cannot kick all’.

Any one of the above can screw up investors’ interest. So, brother AAB – please wake up & do some homework. We need a formula that has the power of 10 or more to be competitive & claim a fair share of the world’s FDI.

Otherwise, we can watch the tiger economies grow all around us…whilst we remain as kittens, not even cubs.

Oh yes, add ‘Local & Federal Government’ – bureaucratic controls.

We have so many controls so much so that many things seem to get asphyxiated even before we have picked up enough momentum to run & that includes the ambulance vans (which ran out of petrol – see YB LKS’s other posting on the AMBULANCE TRAGEDY).

WAtch Vietnam put us to shame by 2010, ta’ payah 2020. If we follow PAk LAh’s 2057, I think even Papua New Guinea may beat us.

“Foreign investors also look at political measures taken to promote democracy, unity and stability.â€Â

This observation, I submit, is inaccurate.

Foreign investors do not view government measures at democratization etc for what they are. Foreign investors, at least those that I deal with, in fact receive the good intention of the government that lies behind a policy like the 30% bumiputra equity, not because of the political, economic and equitable ramifications of such a policy but because of the collateral issues of political stability involved and how such issues act to safeguard their investments in the long run. If at all they complain, it is invariably about the lack of suitable bumiputra partners they could hook up with in order to operate efficiently. They don’t care about the political issues of cronyism. They are businessmen whose only concern is in the rate of return of their investments. Long run political stability is but one factor in their consideration relevant only in so far as it affects the return to their investments – in the long run.

Foreign investments in countries like Indonesia and the Philippines which are known to be less politically stable are higher in fact in certain types of industries. Foreign investors may limit certain types of investments in certain types of industries in countries known to be political unstable, with frequent changes of government and hence policies.

Political stability or instability, I submit, is relevant only in so far as the ‘rules of the game’ are not changed midstream and too frequently. More relevant, for example, is the host country’s policy on outward remittance of profits in foreign currencies.

After about 15 days of continuing reading this blog and Malaysia Today website, just wander are we ready this deep in shit?Are we able to get out from this shit once the bumiprinces & princess willing to become commoners, no longer putras & puteris.

uncle Kit, most of our govt ministers can’t read lah

they will only shout in parliament or practice their infamous all-talk-no-action

spin-doctoring is their one and only skill