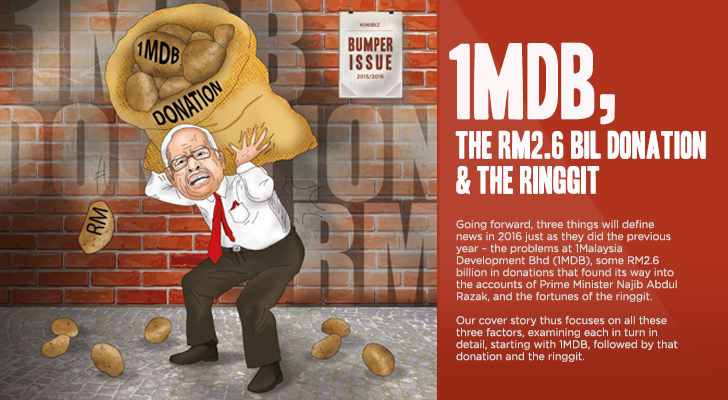

Prime Minister Datuk Seri Najib Razak’s twin mega scandals – the RM2.6 billion “donation” and RM55 billion 1MDB – have performed a virtually impossible feat, entering the new year in some 36 hours with even more questions than answers.

This, despite being the subject of multiple investigations inside the country – at one time, even by the highest-powered multi-agency Special Task Force under four “Tan Sris” led by the then Attorney-General Tan Sri Gani Patail himself until Gani was summarily sacked in a government purge on July 28 whose victims included the Deputy Prime Minister, Tan Sri Muhyiddin Yassin and the Special Task Force dissolved – and the target of separate investigations by at least seven foreign countries, the United Kingdom, Switzerland, Abu Dhabi, Singapore, Hong Kong, Australia and United States.

How could this happen?

On Monday (Dec. 28), Deputy Prime Minister, Datuk Seri Zahid Hamidi urged the people not to fall for the latest report by the Wall Street Journal (WSJ) which cited an unknown source in explaining how US$850 million was transferred from 1MDB to a phantom offshore entity. Continue reading “A virtually impossible feat – Najib’s twin mega scandals entering new year in 36 hours with even more questions than answers”