BY DATUK RAMESH CHANDER & BRIDGET WELSH, GUEST CONTRIBUTORS – 19 OCTOBER 2015

New Mandala

Ahead of the Government’s 2016 budget, Malaysia is staring down fiscal challenges unlike any that it has faced over its history as an independent nation.

In this special in-depth report, Datuk Ramesh Chander and Bridget Welsh examine whether Malaysia can resolve its economic woes, and offer several key reforms to get the nation back on track.

2015 – a year of economic decline

This year has seen tumultuous changes across the entire spectrum of the Malaysian body politic and economy. Unlike in earlier years of Prime Minister Najib Tun Razak’s six-and-a-half year tenure, Malaysia’s economy is now seen to be in trouble, with contracting growth, rising inflation, continued high levels of capital flight, declining consumer and investor confidence, and a depreciating currency.

As the Government prepares to release its upcoming budget later this month, it is important to analyse key economic developments and point to possible solutions. To date, assessments have largely ignored how the underlying structural and policy shortcomings of the Najib administration have contributed to the current economic decline.

Broadly, Malaysia’s economy has faced strong headwinds that are having a sizable impact on economic well-being. Three distinct interrelated forces are at play: global developments, declining leadership confidence and, policy failures tied to an unwillingness to engage in substantive and much needed structural reforms.

Malaysia faces an unfavorable global environment. The slowdown of the Chinese economy, Malaysia’s largest trade partner, has contributed to a sharp decline in Malaysia’s GDP growth. While the US economy has begun a recovery, it has not filled the vacuum as a driver of growth left by China’s slowdown.

Four regional economies are seen to be under strain – Singapore, Indonesia, Thailand and Malaysia. The broad decline of Southeast Asian currencies to the US dollar and drops in exports have cast a pall over the region.

Global drops in oil and gas prices (now at levels less than half of those prevailing a year ago) have had a special impact on Malaysia; Government revenues from petroleum had accounted for almost 40 per cent of total revenue. The fall in other commodity prices, including those of rubber and palm oil, have affected export earnings, all contributing to less funds in government coffers.

Negative global conditions have been exacerbated by a protracted political crisis surrounding the prime minister. The July release of the Wall Street Journal article alleging deposits of nearly US$700 million into the premier’s personal account tied to the 1MDB sovereign fund has raised concerns about Najib’s management of the economy.

Rather than have a thorough investigation of the 1MDB allegations, the Government has undermined efforts to win back confidence. These actions in turn have contributed to rising concerns about governance, extending from challenges to the integrity of Bank Negara to the management of government-linked companies.

With multiple jurisdictions now investigating the transactions involving 1MDB, the crisis has placed Malaysia under a negative international spotlight. The Najib government has responded by attempting to shore up his support at home through patronage for party elites, increased arrests and race-based mobilisation.

The latter has included a Malay chauvinist rally that has raised concerns about the well-being of ethnic minorities within Malaysia and reinforced perceptions of a weak government lacking confidence and stability. Najib’s domestic popularity has reached record lows as he continues to fend off challenges to his position and growing criticism.

Domestic economic conditions are an integral element of the discontent. The adverse external environment, coupled with domestic political developments, have led to a shortfall in private investment.

Private household consumption has slowed down for three primary reasons. The first of these is the rise in inflation expectations which has made consumers reticent; this has been compounded by the imposition of a six per cent GST in April. The depreciation of the ringgit (RM) has further weakened consumer confidence, adding to inflationary pressures and a retail slowdown.

Public spending in real terms has been largely flat. This can be attributable to the lowered public sector investment which has been held back in part by the desire to limit the size of the deficit in order not to breach the self-imposed ceiling of 55 per cent to GDP. An additional factor has been the slow roll out of projects after the announcement of the new Five Year Plan.

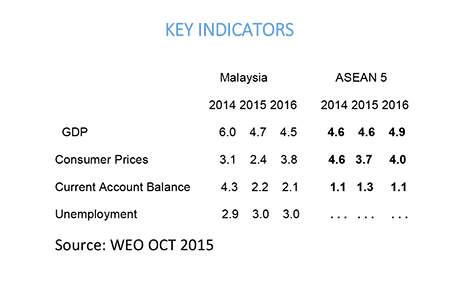

Taken together, the evolution of global markets, political developments and weak domestic policies have contributed to a lower growth rate of GDP in 2015. The IMF in its latest World Economic Outlook (WEO) estimates growth during the current year to be at 4.7 per cent; the external current balance to be 2.2 per cent of GDP and inflation to amount to 2.4 per cent. The WEO projections for 2016 do not anticipate a recovery. Indeed it foresees lower growth in the coming year together with a reduced external balance.

Some structural issues

Although Malaysia had an early start in electronics and was seen as having a strong manufacturing core, it has not been able to build on its technological advantage and move up the value chain in any significant or sustainable manner.

Malaysia has in recent years moved back to a reliance on processing primary commodities centered on the processing of petroleum refining and palm oil processing. These activities have displaced electronics as the leading component of exports. These broad trends have led to a labor force in manufacturing made up largely of workers with no more than a high school certificate, and increasingly a heavy reliance on foreign labour.

In the past decade Malaysia has been a net exporter of capital. Many analysts have contended that the outward flows represent capital flight than outward FDI. Much of the outward FDI flow has been generated by government-linked companies (GLCs), but the outflow in recent months has included the private sector. The domestic business environment has not been friendly, despite many incentives, to private investors.

Many observers have made the case that distortions resulting from the design and implementation of the 1970-1990 New Economic Policy (NEP) and its subsequent incarnations has had negative consequences. One important implication has been a dependence on government contracts in the private sector, feeding an uncompetitive business environment that is seen to promote corruption. At the same time, the GLCs have crowded out private investment in many sectors and prevented small and medium-sized enterprises (SMEs) from growing and introducing innovative processes.

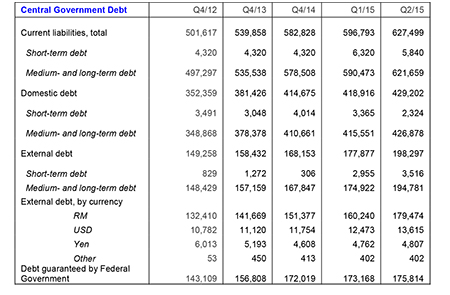

There is little debate over the fact that the Malaysian economy is burdened by a number of structural imbalances which have contributed to the current economic ills. These include the high level of debt, both of the public sector and households. Recent estimates place the Federal Government’s debt at RM 627.5 billion, a level hovering about the self-imposed ceiling. It is also noteworthy that foreign holders account for almost RM 180 billion, accounting for almost 29 per cent of total debt.

In addition to the total debt of RM 627 billion, a conservative estimate of the contingent liabilities by way of loan guarantees amount to just over RM 175 billion. Over and above these levels of debt, there is some uncertainty about off budget borrowings and the viability of some of the government-linked companies.

Source: Derived from Bank Negara: http://www.bnm.gov.my/index.php?ch=statistic_nsdp&uc=2

Based on officially published numbers, a number of conclusions can be drawn. First and foremost, it must be noted that the Federal Government’s debt jumped sharply from RM 501.6 billion at the end of 2012 to RM 627.5 billion in 2015. Continued borrowings at this pace are not sustainable.

A second noteworthy point is that almost 29 per cent of the debt, although denominated in ringgit, is held by foreign holders. This circumstance exposes Malaysia to the risk of further capital flight.

There is some evidence that this scenario is currently in play as foreign fund managers have been liquidating their holdings and remitting funds abroad. These transactions, along with the drop in leadership confidence and global pressures, have contributed to the 30 per cent de facto devaluation of the ringgit from levels prevailing a year ago.

Further liquation and repatriation of debt holdings and equities are highly likely if and when the US Federal Reserve raises interest rates. The 1MDB crisis has drawn attention to the indebtedness of the GLC’s and raised concerns about the transparency and viability in the corporate sector. Thus, Malaysia faces severe challenges over the near term.

There are a number of possible key fallouts from a scenario such as the above playing out. First and foremost, the ringgit will in all certainty come under further pressure. As a consequence, import costs will rise. Imports of intermediate goods, which are disproportionately high in manufacturing in Malaysia, will contribute to raising production costs in manufacturing.

Consumer goods will be subjected to higher costs. Malaysia disproportionately imports many of its basic stables, including rice. Although officially at low numbers, inflation is hitting ordinary citizens particularly hard, as they are reeling from the double impact of the imposition of the GST and a depreciating currency. Through measures such as toll hikes, the Government also has opted to increase transportation costs to consumers during these challenging months.

Thus, a negative inflationary impact is evolving at a time when GDP growth will be lower. Exports are likely to be sluggish given the overall slow growth of global GDP, overshadowed by the slowdown in the world’s second largest economy – China – which also represents Malaysia’s largest trading partner.

Counteracting these trends will inevitably be difficult given Malaysia’s exposure as an open economy. The Government is not well placed to mount counter measures, in the form of pump-priming (stimulating the economy through investment), as it lacks a strong revenue flow from depressed petroleum prices and further constraints because of the absence of headroom to borrow further.

Malaysia’s weak revenue position has been a growing concern, and has not been significantly offset by the imposition of the GST, in part due to failings in the implementation of the tax. The Government’s high dependence on commodities, especially oil and gas, continues to limit revenue growth.

Any hopes that private household consumption, which has contributed substantially to GDP growth in recent years as a result of election-related priming before 2013, will help sustain growth, must be tempered for several reasons. The high level of household debt (estimated at over 80 per cent of GDP) will act as a dampener on private consumption growth.

Coupled with this, stagnant wage levels especially in a soft economy are likely to weaken consumer expenditures. Perceptions of a declining economy have also impacted spending, especially among the large share of Malaysians who make less than $1000 monthly and remain highly vulnerable in the current negative economic climate.

The problems of wages and household debt can be traced back to structural problems in the labour market. Real wages have not substantially increased in decades, especially in manufacturing and parts of the service sector. This has contributed to a persistent brain drain that extends across all of Malaysia’s ethnic communities. Wages are held down by the high importation of foreign labor, a mechanism the government has used to maintain low-end manufacturing.

The large number of migrants has raised concerns about labor conditions and human trafficking. Inadequate resources have been invested in improving the skills of the workforce, with limited development of English-proficiency and problem-solving. Performance in education has declined even as the number of Malaysians entering the workforce have increased. The public sector has been used to hire workers that would be unemployable in a competitive private sector, with the effect being a reduction in the quality of the civil service.

Flawed approaches

Can Malaysia address its economic woes? The prospects for such an outcome regrettably are not bright if global economic developments are taken into account. The Government appears to have few arrows in its quiver.

Ministerial statements that the upcoming budget for the year 2016 will be expansionary with the objective of sustaining growth lacks credibility as the Government has neither the revenue flows nor the ability to borrow and spend. Inevitably the Government will break the ceiling on the deficit, a measure that will undermine credibility especially given the uncertainties projected for 2016. If the Government does persist in increasing spending, the cost of borrowing is likely to be high and Government paper may acquire junk bond status, an event that would have serious consequences.

The problem is the Najib administration’s pump-priming is not working. Not only has it fundamentally failed to address the economy’s structural problems, the Government’s approach has deepened them. The focus on spending has been on non-competitive areas of the economy, with a heavy reliance on government contracts in areas such as construction, land development and infrastructure. As Najib has faced political pressure, he has increased spending under the rubric of Bumiputera programs and projects, weakening competitiveness in the private sector.

To date, spending has concentrated on shoring up the stock market and domestic capital, dominated by government-linked or politically-linked companies. This has done little to strengthen the economy as a whole.

At the same time, funds have arbitrarily been cut from government programs, undermining administration and governance, as civil servants have been undercut. Rather than engage in meaningful civil service reform and lay out a plan that reduces government expenditure effectively and strategically, the trend has been to displace and weaken government departments.

Spending has also involved payments to lower-income citizens under the rubric of BR1M, a people’s aid scheme, and regular bonuses to civil servants. These temporary cash payments have not meaningfully contributed to reducing household debt and been inadequate to cover rising costs from inflation. The Government has not developed a sustainable safety net program that has addressed the impact of current economic difficulties.

Despite denials by the Prime Minister and the Governor of Bank Negara that the Government will not impose capital controls or peg the ringgit, as was done at the time of the 1997-98 East Asian financial crisis, there are some analysts who believe the Government may turn to adopt these measures. Analysts point to the fact that Bank Negara intervened in the market in recent months to prop up the ringgit but failed despite the use of some RM 40 billion of the foreign exchange reserves.

This attempt has demonstrated the futility of trying to defend the ringgit in the current circumstances. Moreover, a ringgit peg is pointless unless accompanied by capital controls. The imposition of the latter would come at a great cost. Markets would act by ostracising Malaysia, thus inflicting high costs in terms of future dealings. Lessons from the 1998 use of these instruments should not be forgotten.

The Government appears to have few options in confronting the crisis it now faces. In the short term, as noted above, the policy approaches adopted are not working. The administration must inevitably accept the need for an in-depth review of available options.

A vital step involves decisive measures to address questions surrounding the 1MDB crisis and restore integrity in the management of the economy. The Government needs to move away from palliative measures such as the recent injection of RM 20 billion into the stock market to prop up equities, for the most part GLCs. The Government needs to come to terms with the fact a dose of austerity measures is needed to restore a degree of credibility.

More fundamentally, the Government must embrace needed economic reforms. It must start with a genuine Public Expenditure Review conducted by an independent team. As a further step, it should postpone implementation of large infrastructure projects like the high speed railway. It needs to streamline the bloated public service; a starting point should be a full-scale review of the functioning of the service.

More transparent procurement practices would not only result in savings but would reduce opportunities for corruption. An immediate launch of a program to hive off loss making GLCs and further privatisation of the larger GLCs is called for.

Simultaneously, there needs to be a proper assessment of how to ameliorate the impact of economic difficulties on vulnerable communities. Part of this involves a serious program to strengthen the labor market, increase productivity and wages. Genuine reform measures will greatly enhance the credibility of the Government and introduce better governance.

This rather bleak review of the current and near term economic scene is sobering. Malaysia faces challenges unlike any that it has faced over its history as an independent nation. Unlike in the 1997-8 East Asian financial crisis, the Government does not have favourable commodity prices to shore up its financial position. It lacks a safety net.

The prospects of avoiding further economic hardships are not bright. It is therefore necessary to look to taking measures that correct the structural deficiencies that have snared Malaysia in the middle income trap.

Getting back on track

The program of economic reforms contemplated by Najib soon after he assumed office as the sixth Prime Minister have been shelved. Instead, the Government has perpetuated affirmative action programs carried out under the New Economic Policy first introduced in the early 1970s and made the economy less competitive. Income inequalities have widened, as the Government has been seen to be serving vested interests and favoring the wealthy. These distortions have contributed to relatively slower growth in terms of Malaysia’s full potential.

Meaningful changes are needed to enhance the labour market. The reluctance to address urgently needed reforms in the field of education has had serious consequences. Standards have declined; the unwillingness to take on the need for strong skills in the areas of science, technology and English language proficiency and to allow space for creativity and independent thinking had led to the system producing, paradoxically, large numbers of graduates that do not match labour market demands. At the same time the market faces shortages of language proficient, problem-solving and technically oriented workers.

Concerns about good governance and public accountability have been largely ignored. While civil society has made calls for reforms and greater transparency, little progress has been made in addressing key concerns. Corruption looms large as an issue, especially in light of the 1MDB crisis, and there have been increasing calls for a fairer implementation of the law and increased transparency. These issues directly impact the economy as they involve confidence, competitiveness and ultimately growth.

Although the Government indicated that it would take steps to disinvest by privatising its holdings in the GLCs, few measures have been taken thus far. The GLCs continue to impact on the functioning of the business and commercial sectors. As noted earlier, they play a pivotal role in restraining private investment, and more so than the other distortions associated with public spending.

Malaysia can no longer evade the need to adopt and implement a coherent set of reforms that address the structural constraints that have contributed to the present crisis.

The key reforms can be listed as follows:

- Labour market reforms: Remove constraints to changes in wage levels; limit inflows of migrant labour; enhance vocational training to improve the skill pool; relax the ethnic composition of public sector employment and remove discrimination in the labour market; enhance labour mobility and productivity.

- Education: Strengthen the teaching of science and technology; emphasis the need for proficiency in English; expand post-secondary training in science, engineering and information technology. Foster creativity with investments in the arts and sciences; increase problem-solving and analytical thinking with more independent education initiatives; raise achievement standards.

- GLCs: Develop and implement a program for Government disinvestment. Loosen the regulatory framework; create a level playing field for SMEs to have greater opportunities; increase transparency in GLCs

- Government processes and programs: Introduce more transparent processes in the purchase of goods and services by the public sector; greater accountability and openness in budgeting; a reduction of bureaucratic procedures; a comprehensive public expenditure review; an overall review of the tax system; strengthen the role of technocratic expertise in oversight over the economy, especially in the Ministry of Finance; develop a stronger social safety net to address growing economic difficulties among vulnerable groups.

- Institutional reforms: Restore the independence of the law enforcement agencies; safeguard the independence of the judiciary; safeguard the integrity of Bank Negara; strengthen the independent enforcement of the anti-corruption bodies; increase the checks and balances in the management of GLCs; reduce the size of the public sector and centralisation of the executive.

Conclusion

Emerging from the current economic crisis will demand resolute measures. These inevitably will not be pain free. In the immediate future, measures such as an expansionary budget, further injection of funds into the stock market, attempts to shore up the ringgit and so on, may placate sentiments in the immediate. But these palliatives are likely to cause more harm than good. They will not address the deep-seated malaise that grips the economy.

The overall prospects for Malaysia’s economy are thus rather dim. Malaysia may face a painful adjustment. Reform measures will need to be adopted, including steps to address the problems associated with the 1MDB crisis; in the event these steps are not taken, market forces are unlikely to turn around Malaysia’s negative fortunes.

Beyond the immediate challenges, the nation needs to urgently address the set of structural impediments that are limiting the achievement of sustainable growth over the medium term. If the Malaysian economy is to emerge from the present crisis as a robust entity capable of coping with future external shocks, it will need to embark on a program of reforms that boldly address these structural limitations.

The long delayed program of reforms cannot be further postponed if the nation is to avoid irreparable long term damage. While vested interests are likely to resist, the overall interests of the country demand the adoption and implementation of structural reforms.

Datuk Ramesh Chander was the first head of Malaysia’s Department of Statistics. He served as a Senior Adviser to the World Bank’s Chief Economist/Senior Vice President before retiring from the Bank.

Bridget Welsh is Professor of Political Science at Ipek University, Senior Research Associate at the Center for East Asian Democratic Studies of National Taiwan University, Senior Associate Fellow of The Habibie Center, and University Fellow of Charles Darwin University.

There is another aspect not discussed which is at privatisation and GLC are increasingly PARASITIC – from toll increases, power and water projects, Privatisation rather Piratisation OF ENFORCEMENT, DEFENCE contracts and looming HEALTHCARE INSURANCE and Education. Even GST, if further increase can only be because of Piratisation.

It is already too late. As many as 50,000 people give up their citizenship and more migrating each year..The tide is NOT reversible even if UMNO/BN now is out of office. The trust is broken and likely the exodus will get much worst if UMNO/BN joins up with PAS. We are at replacement rate of population right now but with migration set to worsen its actually on the decline. In ten years or less the citizen working age population will peak which should result in start of decline in GDP – the only way to delay (NOT AVOID) is giving out citizenship to foreign workers we are bringing in marking a permanent shift in character of our nation with a worst Pandora box that makes Mahathirism benign by comparison.

In Malaysia’s case, it is not just snafu, it is a total fubar……..

All the measures you suggest are politically inexpedient for the ruling government because reform will spell the end of the UMNO led government. We have passed the event-horizon.

Stop politicking now. LGE please about time u walk the ground level and see how atrocious it is to drive in Penang especially the town area with the stupid traffic lights holding up cars for long period. No proper planning.

LKS, give that stupid apology to the Speaker, it’s a stupid ploy to get you suspended and prevent you from attending the budget session. Do all of us and yourself a favour and make sure of your presence in Parliament.