Financial Times

August 9, 2015 5:35 am

Jennifer Hughes in Hong Kong and Andrew Whiffin in London

Happy 50th birthday Singapore.

Whatever is said about the Lion City — its nanny state tendencies, a seeming obsession with finicky rules, the challenges it faces sustaining its position — its economic achievements of the past 50 years are substantial.

The death of Lee Kuan Yew in March this year gave an outlet for a raft of reviews of Singapore’s performance.

Here we present a few charts to put the city state in a global context.

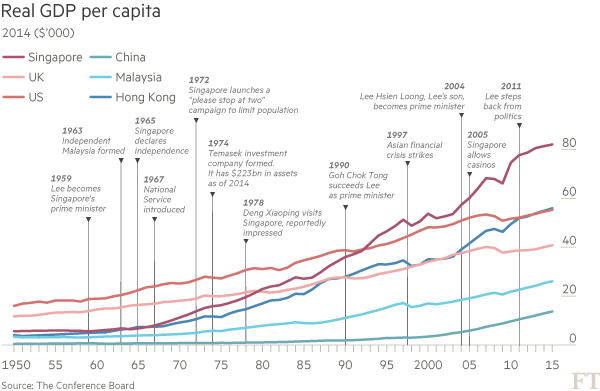

Gross domestic product per capita has risen at a 10 per cent compound annual growth rate for the past five decades in one of the world’s best performances, according to economists at Morgan Stanley.

That puts Singapore on a par with the likes of far older countries such as Denmark, Sweden, Canada and the Netherlands.

Its performance is even more impressive when considering that GDP per capita was roughly a third of those countries’ level in 1965.

That fast growth has, however, left Singapore facing challenges.

The labour immigration that spurred its performance before the global financial crisis has widened income inequality and strained infrastructure.

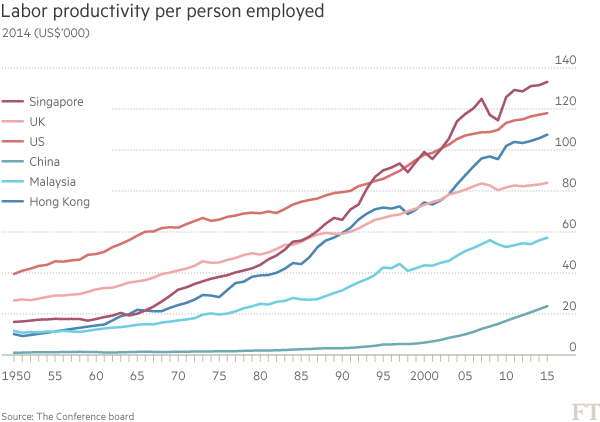

Singapore has achieved a lot of its growth from improving productivity. The question however is how it copes with the impact of slowing immigration and an ageing population on workforce output.

As a contribution to GDP, productivity gains have fallen from about 0.9 percentage point a year measured over the past decade, to about 0.3 percentage point in each of the past five.

Higher fertility rates could help — but only after a couple of decades if they do begin to rise once more. And politically, the tougher immigration rules imposed since 2010 are unlikely to be modified.

That leaves more nebulous factors such as innovation, where Singapore is lagging behind and could in theory take action. While it ranks number two globally in terms of competitiveness, according to the World Economic Forum, it ranks only 11th forinnovation and business sophistication.

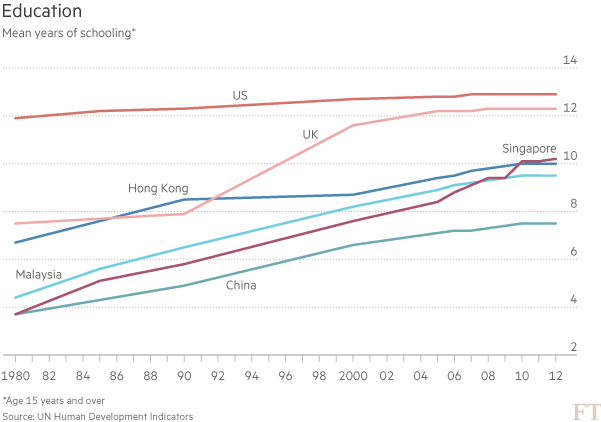

Education is one area where Singapore has been driving hard.

Part of the city state’s pragmatic approach has involved shifting its training to where it is needed, from the early days when vocational training was key through the transition to a higher-skilled white-collar workforce.

Now the focus is on creativity and innovation — somewhat at odds with a previous emphasis on heavy use of standardised testing.

Spending on education certainly has room to improve.

According to Morgan Stanley, Singapore’s public spending on education amounts to about 3 per cent of GDP — far behind the Nordic countries, which spend 7 per cent or more, and even Malaysia at its 6 per cent.

For wider comparison, the US spends about 5.5 per cent and Hong Kong 3.5 per cent.

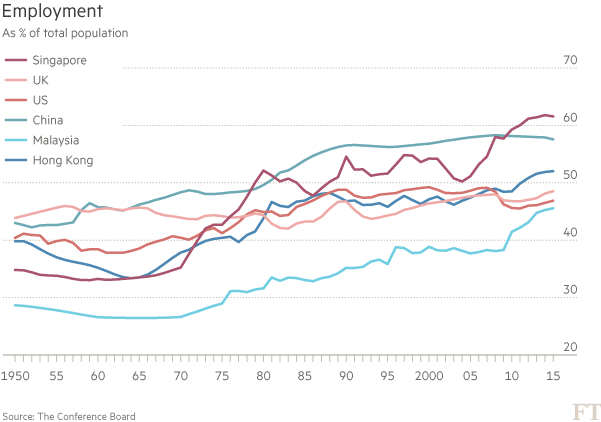

Singapore’s high employment is another notable achievement.

After high levels of joblessness in the 1960s, Singapore sought international capital to kick-start industrialisation and achieved full employment in the 1970s.

The slowdown in immigration in recent years has helped keep the employment rate high, but has not so far produced significant wage growth.

Instead, employees are taking home a larger share of GDP — which is slowing — but companies are unable to pass on any labour costs rises by raising prices.

Singapore is wealthy, and Singaporeans — or rather residents, whether Singaporean or other — who have it increasingly do not mind flaunting it. Flashy luxury cars are increasingly prevalent downtown.

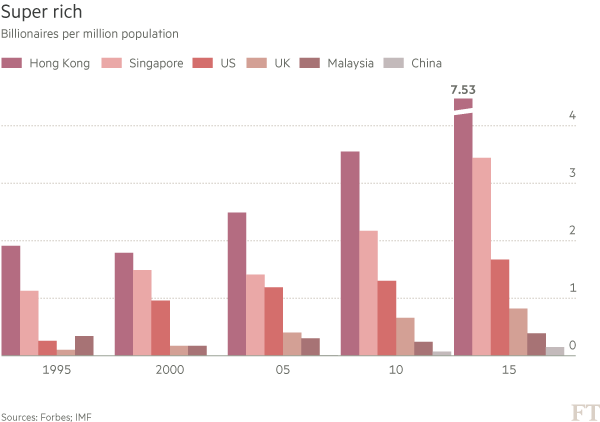

Billionaire headcounts may not be the best way of measuring true economic progress, but they still say something about where the wealth is accruing.

In this case, China’s billionaire boom — a 38 per cent compound annual growth rate in the past decade — has clearly overflowed into Hong Kong, Singapore’s closest rival. And Singapore’s own 9 per cent growth rate is not that far short of Hong Kong’s 12 per cent.

Don’t compare them with Singapore la. They will get excited again like the low yat fiasco.

How did Spore do so well?

When was that ‘deviation’?

National Service, 1967. GDP.

Labour productivity per person employed. 1967

Education and more. Security and safety.

I was in Spore during her National Day weekend.

I had chicken rice for only S$3.50. It’s cheap if you earn S$1000 a month.

In Malaysia if you earn RM1000 today, chicken rice is now rm5.00. But I was told GST is 7% in Spore. How come food is so cheap?

I saw many Myanmar foreign workers, and i believe they are having a good life.

Alamak, all the graphs are going up. Are you sure you have got the picture right way up?. How can a wee dot do this miracle. Perhaps we have to learn somethings from the Singaporeans. Only thing about Singapore is that there are no coconut trees, turtled beaches and mountains there; and you can’t chew gum or spit red sireh-juice on the streets.

One issue which even TUN was envious is the way PSA has gone international to make us$1.25 Billion last year! He thought by piratizing our ports our operators could give PSA a run for their money! Today, in order to earn more revenues, they just increase handling costs of the import and export containers, knowing for sure that those international shipping lines would not pay any increase! In fact, the lines would simply add up their terminal handling charges against the local shippers! Today, PSA operates nearly 50 terminals worldwide not forgetting that they also own 20% of Hutchinson! Also note that Kuantan port is now 60% controlled by the Chinese Peihu port group in which PSA has a major share! It would be better that we concentrate on improving our efficiency and productivity of our piratized ports rather than trying to compete with nothing except words and slogans!