Just two mega-projects and Oil, Gas & Energy, really. Behind the apparently impressive RM176 billion of investments achieved in the ETP so far is a sobering picture. The MRT and Petronas’ RAPID mega-projects make up 55% of total investments in Entry Point Projects (EPPs). Going by National Key Economic Area, 53% of investments were in just one NKEA – Oil, Gas & Energy.

Zero progress in Financial Services. Not a single EPP has been announced in this NKEA which is targeted to deliver up to 15% of the income boost envisaged in the ETP. The Kuala Lumpur International Financial District is not a Financial Services EPP and is not even mentioned in Bank Negara’s Financial Services Blueprint 2011 to 2020. Is PEMANDU in sync with the key financial regulators Bank Negara and the Securities Commission?

Broad-based investments are necessary to transform Malaysia. The RM800 billion of investments targeted by the ETP are spread across 131 EPPs in 12 NKEAs. This will deliver the broad-based growth that will turn Malaysia into the high-income nation that PEMANDU envisages. But progress has been skewed towards just one NKEA and a few mega-projects. The ETP currently appears to be business-as-usual, government-linked mega-projects rather than private sector-led transformation.

By design or necessity? The initial focus on a few mega-projects and one NKEA might be a sensible strategy. Or it might have been forced by the lack of private sector interest in the ETP. PEMANDU will no doubt claim the former. We think it is the latter. Time will tell. We shall be monitoring.

Diversity of projects is as important as size of investment

The ETP1 team at PEMANDU2 has achieved nearly a quarter of its investment target in just over a year. RM176 billion of investments in EPPs (Entry Point Projects) have been announced3. This is equivalent to 22% of the cumulative RM800 billion investments targeted for the entire ETP until the year 2020.

That is indeed a remarkable achievement. However, the ETP is not just about large investment numbers. Those investments must ultimately transform Malaysia into a high-income nation. To that end, the ETP Roadmap chose to prioritise 131 Entry Point Projects (EPPs) across 12 National Key Economic Areas (NKEAs).

The 12 NKEAs are a broad mix, ranging from service-based economic activities such as Business and Financial Services to heavy engineering-oriented Oil, Gas and Energy projects4. The EPPs range in size from RM3 million to RM84 billion5.

Zero progress on financial services NKEA

We now focus on Diversity6 – the second ‘D’ in our DEEDS framework. We compare the composition of the EPPs heralded in the eight ETP updates with the spread envisioned in the ETP Roadmap Report.

How spread out are the 114 EPPs and RM176 billion of committed investments achieved so far? A diverse distribution of project sizes across the twelve NKEAs indicates a healthy and balanced progress. Conversely, a narrow distribution raises questions about the lack of broad progress and concerns about the overall viability of the ETP.

The prognosis is poor:

-

Mega-projects dominate. Just two projects – the MRT and RAPID by Petronas – account for 55% of the investments so far.

-

Just one NKEA accounts for the majority of investments. The Oil, Gas & Energy NKEA contributed 53% of the investments so far. In fact, six of the top 10 investments so far are in this NKEA.

-

Of greater concern is that there is no EPP in the Financial Services NKEA.

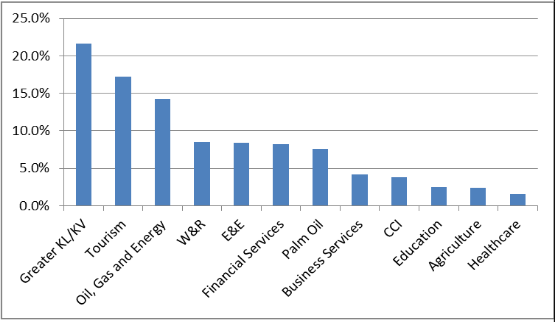

Chart 1: The single largest NKEA is supposed to account for only 22% of total EPP investments …

Sources: ETP Roadmap and Ong Kian Ming’s analysis

A more detailed breakdown is set out in Appendix 1.

Important clarification on RM800 billion of EPP investments vs RM1.4 trillion ETP total

The RM1.4 trillion total investments that PEMANDU prefers to highlight comprises RM800 billion of investments in EPPs and RM600 billion in 60 business opportunities identified in the ETP Roadmap Report7. Business opportunities ‘capture the potential of the sector to grow organically. Some business opportunities will be triggered by the successful execution of EPPs’8.

Source: REFSA

Chart 2: … but so far, just two EPPs account for 55% of total investments in the ETP …

As the ETP Updates cover only EPPs, we consider RM800 billion the appropriate investment benchmark.

Sources: ETP Updates and Ong Kian Ming’s analysis

Chart 3: … and one NKEA accounts for 53% of total investments.

Sources: ETP Updates and Ong Kian Ming’s analysis

Is PEMANDU in sync with Bank Negara and the Securities Commission?

Financial Services is mainly under the purview of Bank Negara Malaysia and the Securities Commission – key policy “enablers”, in PEMANDU’s parlance. Bank Negara recently released its Financial Services Blueprint 2011 to 20209.

Nearly all of the EPPs under the Financial Services NKEA10 can be found in the Blueprint. However, the similarity ends there. The language and thrust of the Blueprint differ markedly from that of the ETP Roadmap and the ETP updates. We found only one mention of the ETP and no reference whatsoever to the other metrics that PEMANDU emphasises – EPPs, incremental GNI contribution and amount of public and private sector investments.

The Financial Services NKEA is important to the ETP. PEMANDU anticipates it will contribute RM121 billion or 15% of the incremental GNI (gross national income) targeted11. It is imperative that progress within this very important NKEA be tracked. It would be most helpful if PEMANDU, together with the two other main stakeholders – Bank Negara and the Securities Commission – would issue a joint communiqué clarifying the likely investments, jobs and incremental GNI contribution from this NKEA in the short, medium and long term.

KL Intl Financial District is not a Financial Services EPP

The proposed Kuala Lumpur International Financial District (KLIFD) by 1MDB was initially listed as a common enabler under the Financial Services NKEA. KLIFD was subsequently elevated to EPP status, but reclassified under the Greater KL / Klang Valley NKEA12. The reclassification is puzzling. The scant details are worrying13. The fact that KLIFD is not mentioned at all in Bank Negara’s Financial Services Blueprint 2011 to 2020 is alarming.

The ETP Roadmap Report says, “The Kuala Lumpur International Financial District … will allow Kuala Lumpur to attract higher calibre financial human talent to together help promote a vibrant financial services industry. This will also raise Malaysia’s profile in the international arena and support the country’s brand14.”

But buildings alone cannot make a financial centre. What is more important is the soft infrastructure – the rules and regulations and general environment – fostered by Bank Negara as the primary regulator. The Labuan International Business and Financial Centre (Labuan IBFC) is mentioned 25 times in Bank Negara’s Blueprint. KLIFD is conspicuous in its omission.

The absence of clear support from Bank Negara and its reclassification into the Greater KL/Klang Valley NKEA suggests that the Kuala Lumpur International Financial District is another massive construction project rather than an important foundation of efforts to develop the financial services sector. This view is given credence by the various tax incentives granted to KLIFD in the 2012 Budget announced by Prime Minister Dato’ Seri Najib Razak.

The inducement for more new office space is puzzling. International real estate service firm CB Richard Ellis Malaysia points out that projects such as the KLIFD would exacerbate the oversupply in Kuala Lumpur15. In this environment, it is even more crucial that policy enablers such as Bank Negara are fully on board to help create new opportunities and demand to fill the fresh supply of office space.

Progress so far is just mega-projects and one NKEA

Leaving aside Financial Services, the diversity of EPPs still leaves much to be desired. The EPPs are heavily skewed towards a handful of mega-projects and one NKEA in particular:

-

Firstly, just two mega-EPPs – the RAPID project by Petronas and the MRT – contribute 55% or RM97 billion of the announced RM176 billion investments16.

-

Secondly, investments in EPPs in the Oil, Gas and Energy NKEA dominate. Oil, Gas and Energy EPPs make up 53% or RM94 billion17 of the announced investments.

From another perspective, 6 of the top 10 EPPs are in this NKEA.

Table 1: 6 of the Top 10 EPPs by Investment Value are in one NKEA – Oil, Gas and Energy

| EPP | Source of Investment | NKEA | Update No | Investment (RM million) |

|---|---|---|---|---|

| Refinery and Petrochemical Integration Development (RAPID) | GLC | Oil, Gas & Energy | 6 | 60,000 |

| Mass Rapid Transit (MRT) | Government | GKL/KV | 3 | 36,600 |

| ExxonMobil Investments to rejuvenate existing oil fields | Private | Oil, Gas & Energy | 3 | 10,000 |

| Karambunai Integrated Resort City | Private | Tourism | 5 | 9,600 |

| Small Retailer Transformation Programme (TUKAR) | Private | W&R | 4 | 5,430 |

| Infrastructure investment from SHELL | Private | Oil, Gas & Energy | 3 | 5,100 |

| Independent deepwater petroleum terminal from Dialog Group | Private | Oil, Gas & Energy | 3 | 5,000 |

| Infrastructure development from TNB | GLC | Oil, Gas & Energy | 2 | 4,000 |

| Tanjung Agas Oil & Gas Logistics & Industrial Park | GLC | Oil, Gas & Energy | 2 | 3,000 |

| Mines Wellness City | Private | W&R | 3 | 3,000 |

| Total | 141,730 |

Sources: ETP Updates by PEMANDU and Ong Kian Ming’s analysis

The reliance on just two projects and the slant towards the Oil, Gas & Energy NKEA would be even more pronounced if:

-

The now much higher cost of the MRT is used. The RM36.6 billion investment value still being officially cited is a 2009 estimate subject to inflation. Also, the cost of land acquisition and rolling stock is not included18. Some reports suggest the cost is now in the region of twice as much;

-

Investment numbers for the intensification of exploration activities by Petronas and the formation of the Malaysian Nuclear Power Corporation announced in Updates 5 and 6 respectively are included19. The investment figures for these two very large EPPS were surprisingly not given by PEMANDU when they were announced during the updates.

Based on the Roadmap, the nuclear power plant (EPP 11) is expected to generate RM21.3 billion of investments while the Petronas activities (EPP 3) will contribute RM18.4 billion. Including these numbers, Oil, Gas and Energy NKEA would have accounted for even more of the total investments in EPPs announced so far20.

3 mega-projects make up nearly ⅔ of non-Oil, Gas & Energy NKEAs

It might be argued that PEMANDU is a victim of its own success in stimulating EPPs within the Oil, Gas & Energy NKEA. The RM94 billion of investments committed to this NKEA so far is already 83% of the RM113 billion envisaged throughout the entire ETP period.

The massive investments here would naturally dwarf the other NKEAs. However, leaving aside the heavy reliance on Oil, Gas & Energy, the same diversity issues afflict the other 11 NKEAs:

-

The slant towards mega-projects is even more pronounced. Just three mega-projects – the MRT, TUKAR and Karambunai Integrated Resort21 – account for RM52 billion or nearly ⅔22 of non-Oil, Gas & Energy EPPS;

-

Just one NKEA – Greater KL/Klang Valley – accounts for RM40 billion or nearly half23 of investments within the non-Oil, Gas & Energy NKEAs. The Palm Oil, Agriculture and Business Services NKEAs languish at the bottom. And recall that there are no Financial Services sector EPPs.

Chart 4: Just three mega-projects account for nearly 2/3 of non-Oil, Gas & Energy EPPs

Sources: ETP Updates and Ong Kian Ming’s analysis

Chart 5: Greater KL/KV took nearly half of all non-Oil, Gas & Energy investments

Note that there are zero Financial Services EPPs so far.

The slant towards Greater KL/Klang Valley would be even worse if numbers for the Kuala Lumpur International Financial District and the increased cost estimate for the MRT are included.

Sources: ETP Updates and Ong Kian Ming’s analysis

Excluding the 3 mega-projects, just RM30 billion of investments was generated across the 11 non-Oil, Gas & Energy NKEAs last year. To meet its ETP target, PEMANDU must generate RM67 billion per year of investments for the remaining period of the ETP. Can it pick up the pace?

The ETP Roadmap does outline some other ambitious projects. But these are also projects we are dubious about. Our scepticism is further fuelled by PEMANDU not mentioning the investment numbers when it announced these EPPs in its updates. Two examples are:

-

The Unified Malaysia Sale (EPP 11) under the Wholesale and Retail NKEA. In the Roadmap, the EPP is supposed to generate RM4.7 billion of investments. We think RM4.7 billion is a massive amount merely to organise a sale; and we noticed hardly any publicity from May to August last year when the sale supposedly took place. No figures were given when this EPP was announced in Update 6; and

-

The Invest KL EPP under the Greater KL/Klang Valley NKEA. Attracting 100 of the World’s Most Dynamic Firms within Priority Sectors (EPP1) is supposed to require funding of RM82.2 billion. Invest KL was announced as an EPP in Update 7, without numbers. We think RM82.2 billion to attract 100 firms is very expensive – it works out to RM820 million per firm. For example, the global financial hub of oil services giant Schlumberger announced so far is expected to need only RM268 million of investment.

Grade ‘C’ for diversity

Nevertheless, in keeping with our commitment to evaluating PEMANDU on its own terms, we shall not pass judgment on these projects at this juncture. However, we would also remind readers that private investments are running at only about half the target rate, which we covered in Part 4 – Private Enterprises are Rejecting the ETP.

PEMANDU now has the dual task of catching up on EPPs in NKEAs besides Oil, Gas & Energy and stimulating private investments. For now, we grade PEMANDU ‘C’ for Diversity – its ability to deliver a variety of EPPs across a broad swathe of sectors.

The jury is still out on whether the focus on a few mega-projects and one NKEA is driven by design or necessity. On the one hand, it is sensible to prioritise the large-ticket items. On the other hand, the focus on government-linked mega-projects might have been forced by the tepid private sector response to the ETP. Time will tell. We shall be monitoring.

Appendix 1: Breakdown of Projected Investments by NKEA, EPPs and Business Opportunities

The RM1.4 trillion total investments that PEMANDU prefers to highlight comprises RM800 billion of investments in EPPs and RM600 billion in 60 business opportunities identified in the ETP Roadmap Report24.

Business opportunities ‘capture the potential of the sector to grow organically. Some business opportunities will be triggered by the successful execution of EPPs’25.

Table 2: Breakdown of investments by NKEA, EPPs and Business Opportunities

| Projected Investment | EPPs (RM million) | Biz Opportunities (RM million) | EPPs + Business Opportunities (RM million) | Source | |||||

|---|---|---|---|---|---|---|---|---|---|

| NKEA | Public | Private | Total | % | Total | % | Grand Total | Grand Total % | |

| Wholesale & Retail | 0.4 | 66.7 | 67.1 | 8.4% | 187.6 | 30.3% | 254.7 | 18.0% | Exhibit 8-2, pg 275 |

| Oil, Gas and Energy | 0.6 | 112.7 | 113.3 | 14.3% | 104.2 | 16.8% | 217.5 | 15.4% | Exhibit 6-19, pg 202 |

| Financial Services | 0.6 | 64.6 | 65.2 | 8.2% | 145.8 | 23.6% | 211.0 | 14.9% | Exhibit 7-10, pg 247 |

| Tourism | 4.6 | 132.0 | 136.6 | 17.2% | 67.3 | 10.9% | 203.9 | 14.4% | Exhibit 10-10, pg 349 |

| Greater KL / KV | 57.8 | 114.1 | 171.9 | 21.6% | 0.0 | 0.0% | 171.9 | 12.2% | Exhibit 5-16, pg 156 |

| Palm Oil | 2.9 | 56.8 | 59.7 | 7.5% | 64.5 | 10.4% | 124.2 | 8.8% | Exhibit 9-10, pg 306 |

| Electronics and Electrical | 8.5 | 58.2 | 66.7 | 8.4% | 11.7 | 1.9% | 78.4 | 5.5% | Exhibit 11-6, pg 394 |

| Communications Content & Infrastructure | 1.0 | 29.3 | 30.3 | 3.8% | 21.2 | 3.4% | 51.5 | 3.6% | Exhibit 13-17, pg 468 |

| Business Services | 3.1 | 30.0 | 33.1 | 4.2% | 8.1 | 1.3% | 41.2 | 2.9% | Exhibit 12-13, pg 429 |

| Education | 10.3 | 9.6 | 19.9 | 2.5% | 0.1 | 0.0% | 19.9 | 1.4% | Exhibit 14-11, pg 506 |

| Agriculture | 8.2 | 10.7 | 18.9 | 2.4% | 2.9 | 0.5% | 21.8 | 1.5% | Exhibit 15-8, pg 546 |

| Healthcare | 0.3 | 11.6 | 11.9 | 1.5% | 5.3 | 0.9% | 17.2 | 1.2% | Exhibit 16-16, pg 583 |

| Total | 98.3 | 696.3 | 794.6 | 100.0% | 618.7 | 100.0% | 1,413.2 | 100.0% | |

Sources: ETP Roadmap Report and Ong Kian Ming’s analysis

In its ETP Updates, PEMANDU furnishes information only on EPPs. Business Opportunities are not covered in the ETP Updates. As such, we consider RM800 billion the appropriate investment benchmark when evaluating PEMANDU’s progress so far on generating investments.

Appendix 2: The gap between progress on number of EPPs announced and investment values

Astute readers will wonder at the gap between the number of EPPs announced and the total investments so far. 87% or 114 out of a total 131 EPPs have been announced. However, the RM176 billion of investments announced lags far behind at just 22% of the total expected.

Using a simple ratio suggests that announced investments should be RM696 billion26. Why the large gap? There are two main reasons:

-

PEMANDU omits investment numbers for some announced EPPs. The nuclear power plant, Petronas intensification activities, Unified Malaysia Sale and Invest KL mentioned in this Focus Paper are examples of EPPs which have been announced but for which investment figures were not disclosed;

-

Not all the investment value in each EPP is realised when it is announced. For example, RM39 billion is the figure given for EPP 12 – Improving Rates, Mix and Quality of Hotels in Malaysia27. However, the projects announced so far – Majestic (Update 2), Datai (Update 3) and Pulau Gaya (Update 3) – total less than RM3 billion in committed investments.

Whether the total investment expected in this and other similar EPPs is realistic or can ultimately be realised, we leave to the judgment of our readers and the good hands of the ETP team at PEMANDU.

________

1 The ETP calls for 131 entry point projects (EPPs) within 12 National Key Economic Areas (NKEAs), which will pour RM1.4 trillion worth of investment into the economy and create 3.3 million new jobs by 2020.

2 The acronym that the Performance Management and Delivery Unit within the prime minister’s department is better known by. PEMANDU is the government agency that created and is now steering the ETP.

3 These were announced in the 8 ETP Updates so far following the launch of the ETP. The updates are available at http://etp.pemandu.gov.my/Progress_Update-@-Progress_Update.aspx. Retrieved on 29 Dec 2011.

4 The 12 NKEAs are: Agriculture; Business Services; Education, Electronics and Electrical; Financial Services; Healthcare; Greater KL/Klang Valley; Oil, Gas and Energy; Palm Oil; Communications, Content and Infrastructure; Tourism; and Wholesale and Retail.

5 Pages 340 and 429 of the ETP Roadmap Report. RM3m is to strengthen the accounting sector within the Business Services NKEA. RM84 billion is to enhance connectivity to priority medium haul markets under the Tourism NKEA.

6 We had initially named this metric ‘Distribution’. We now consider ‘Diversity’ the more appropriate term.

7 The exact projected investments are RM795 billion in EPPs and RM619 billion in business opportunities, giving a total of RM1,414 billion.

8 Pg.11, Executive Summary, ETP Roadmap Report.

9 A copy can be downloaded at http://www.bnm.gov.my/files/publication/fsbp/en/BNM_FSBP_FULL_en.pdf. Retrieved 29 Dec 2011.

10 For example, Bank Negara’s efforts to turn Malaysia into a global hub for Islamic finance and to create an integrated payment eco-system are cited by PEMANDU as two EPPs which are expected to generate significant incremental GNI and create high-income jobs.

11 It is also expected to account for RM65 billion of investments in EPPs, equivalent to 8% of the total.

12 http://etp.pemandu.gov.my/Progress_Update-@-1Malaysia_Development_Berhad.aspx. Retrieved 17 Feb

13 Do peruse the 1MDB website www.1mdb.com.my/klifd1/global-financial-city to evaluate for yourself. We checked on 17 Feb 2012.

14 Pg. 246, ETP Roadmap Report.

15 KL faces property glut as economy bites. Lee Wei Lian, Malaysian Insider, 31 Oct 2011. Available at www.themalaysianinsider.com/business/article/kl-faces-property-glut-as-economy-bites/. Retrieved 20 Feb 2012.

16 RM60 bil0lion Refinery and Petroleum Integrated Development (RAPID) project by Petroliam Nasional Bhd (Petronas) and the RM37 billion MRT project under the Greater KL/KV NKEA. Note that the cost estimate for the MRT has since been revised upwards. PEMANDU has yet to formally announce the new number but it has been speculated to be in the region of RM70 billion.

17 The total announced in the ETP updates so far is RM94,448 million, which we round down to RM94 billion.

18 MRT may cost more than RM36 billion. Malaysiakini, 11 Jan 2011. Available at http://etp.pemandu.gov.my/News_-%E2%97%98-_Events-@-MRT_may_cost_more_than_RM36@6bil.aspx. Retrieved on 20 Feb 2012.

19 http://etp.pemandu.gov.my/Progress_Update-@-Malaysia_Nuclear_Power_Corporation.aspx and http://etp.pemandu.gov.my/Progress_Update-@-Intensifying_Exploration_Activites.aspx. Retrieved 17 Feb, 2012.

20 Taking them at their Roadmap Values, the total investments in the Oil, Gas & Energy NKEA would rise to RM133 billion, and it would account for 62% of total investments announced so far.

21 MRT RM37 billion and TUKAR RM5 billion by the government/GLCs and RM10 billion Karambunai Integrated Resort (Karambunai IR) by the private sector. Note that we are dubious about Karambunai IR, where the investment cost tripled to nearly RM10 billion from RM3 billion in 6 short months from its first mention to its announcement in the 5th ETP Update. We estimate Karambunai IR needs 2.8 million visitors per year just to break even, if the investment is RM10 billion. This is more than all the passengers arriving at Kota Kinabalu airport! Details in Part 3 (iii) – Execution: Doubtful EPPs, doubtful achievements and due diligence. Available at www.refsa.org.

22 63.4% to be more accurate. RM52 billion, as a percentage of total RM82 billion.

23 48.8% to be more accurate. RM40 billion, as a percentage of total RM82 billion.

24 The exact projected investments are RM795 billion in EPPs and RM619 billion in business opportunities, giving a total of RM1,414 billion.

25 Pg.11, Executive Summary, ETP Roadmap Report.

26 87% of RM800 billion total investments in EPPs expected throughout the ETP = RM696 billion.

27 Pg. 340, ETP Roadmap Report.

The story so far

Part 1, Let’s evaluate PEMANDU on its DEEDS, introduced our evaluation framework.

Part 2, We won’t really be twice as rich in 2020, found us declaring “It does not compute!” PEMANDU’s target is to double nominal income per capita to RM48,000 by 2020. But using its forecasts for income and population growth, and inflation, the target should be RM54,145, not RM48,000. Can this ‘roadmap to transformation’ be trusted when the highly-paid PEMANDU team and its costly consultants cannot even get the basic math right?

Part 3(i), PEMANDU strengthens the ‘know-who’ cancer, focuses on the practice of taking credit for pre-existing projects and PEMANDU’s role in cutting red tape. PEMANDU is institutionalising the role of middleman if it cuts red tape only for EPPs. If long-term policy changes are not made, Malaysian innovation, creativity and productivity will continue to lag. It does not matter how good your product or idea is, or how efficiently you can make it, it depends on who you know to get it through the system.

Part 3(ii), The hothouse labs probably killed innovation highlights that the tight timeframe of the lab process incentivised lab participants to favour incumbent companies with pre-existing business plans rather than start-ups with genuinely transformative ideas. Also, the labs would be dominated by incumbents striving to maintain their dominance. Start-ups would not have been able to afford to release staff just to attend the labs for 8 weeks.

Part 3 (iii), Doubtful EPPs; doubtful achievements and due diligence concludes our assessment of PEMANDU’s Execution. The selection of possible ‘dud’ projects – projects with very little hope of success – as EPPs raises serious doubts about the due diligence process at PEMANDU. The RM10 billion Karambunai Integrated Resort needs 2.8 million visitors per year to break-even – more than all the travellers arriving at Kota Kinabalu airport! The multi-billion ringgit plan to transform Tanjong Agas in Pekan from a fishing village to a petrochemical hub has REFSA aghast. It creates redundant infrastructure, and goes against the government’s own master plan identifying the already established Kertih and Gebeng as the focus areas for oil, gas and petrochemical clusters in the Eastern Corridor Economic Region (ECER).

Enterprise is severely lacking so far. Part 4, Private enterprises are rejecting the ETP highlights that the private sector makes up only 35% of the total investments in EPPs, far below the 60% that PEMANDU says is required to take Malaysia to high-income status by 2020. It is understandable that priority is given to government-led, big-ticket infrastructure project in the early days of the ETP. However, PEMANDU’s attempt to paint a rosier picture by citing figures excluding large public sector projects like the MRT draws suspicion that something is amiss. REFSA debunks PEMANDU’s selective figures with a simple cake analogy and some telling numbers.

Note on PEMANDU’s response

Upon hearing that we were writing an evaluation of the ETP, the communications team at PEMANDU kindly arranged interviews with a Director from the Minister’s Office who is also the Director of the Oil, Gas and Energy & Financial Services NKEAs, the Director of the Wholesale and Retail (W&R) NKEA and the Assistant Director of the Tourism NKEA. We are grateful for these interviews and will include clarification points from these interviews in our evaluation. These interviews were recorded by the ETP communications team and we hope that they would be made available online for public access.

About the authors

Visiting contributor Dr Ong Kian Ming holds a PhD in Political Science from Duke University and Economics degrees from the University of Cambridge and the London School of Economics. He is attached to UCSI University, which has been named as the project owner of two Entry Point Projects (EPPs). To avoid any potential conflict of interest, he will not make references to or analyse these two EPPs. He can be reached at im.ok.man@gmail.com.

REFSA (Research for Social Advancement) Executive Director Teh Chi-Chang holds a first class degree in Accounting & Financial Analysis from the University of Warwick, an MBA from the University of Cambridge and the CFA (Chartered Financial Analyst) charter. Prior to joining REFSA, he headed highly-regarded investment research teams covering Malaysia, and was himself highly-ranked as an analyst. He can be reached at chichang@refsa.org.

Help REFSA do more!

REFSA is a not-for-profit research institute that provides relevant and reliable information on social, economic and political issues affecting Malaysians. We aim to promote open and constructive discussions that result in effective policies to address these issues.

REFSA depends primarily on donations to fund its operations. Research such as this consumes much time, expertise and effort. Please contribute if you share our vision for a better Malaysia and support our commitment to impartial, constructive analysis. Donations can be:

-

Made on-line via our website at www.refsa.org.

-

Banked in directly to our Public Bank account number 3128- 1874-30.

-

Cheques should be made out to “Research for Social Advancement Bhd”.

-

Please contact us at info@refsa.org for receipts.

Credit

REFSA allows authorship of derivative works and other transformations of this publication for personal, non-profit/non-commercial use, subject to the inclusion of proper and appropriate credit to “REFSA – Research for Social Advancement”. REFSA expressly prohibits the use of the whole or any part of this publication for defamatory or criminal purposes.

Other Information

The information in this report has been obtained from and is based upon sources that are believed to be reliable but no guarantee is made as to accuracy and completeness.